LEE’S SUMMIT, MO, UNITED STATES, August 6, 2025 /ennovaterz/ — In a strategic partnership, Analytics Logics, Liquid Logics, and Adige Advisory have launched the RTL Performance Dashboard — a first-of-its-kind tool that brings real-time visibility and standardized benchmarking of loan performance to the residential transition loan (RTL) sector.

Powered by historical performance data on more than $40 billion in loans from over 300 private lenders dating back to 2014, this groundbreaking platform enables private lenders, institutional investors, and warehouse providers to analyze and compare portfolio performance across key credit risk factors, including property type, geography, and loan structure.

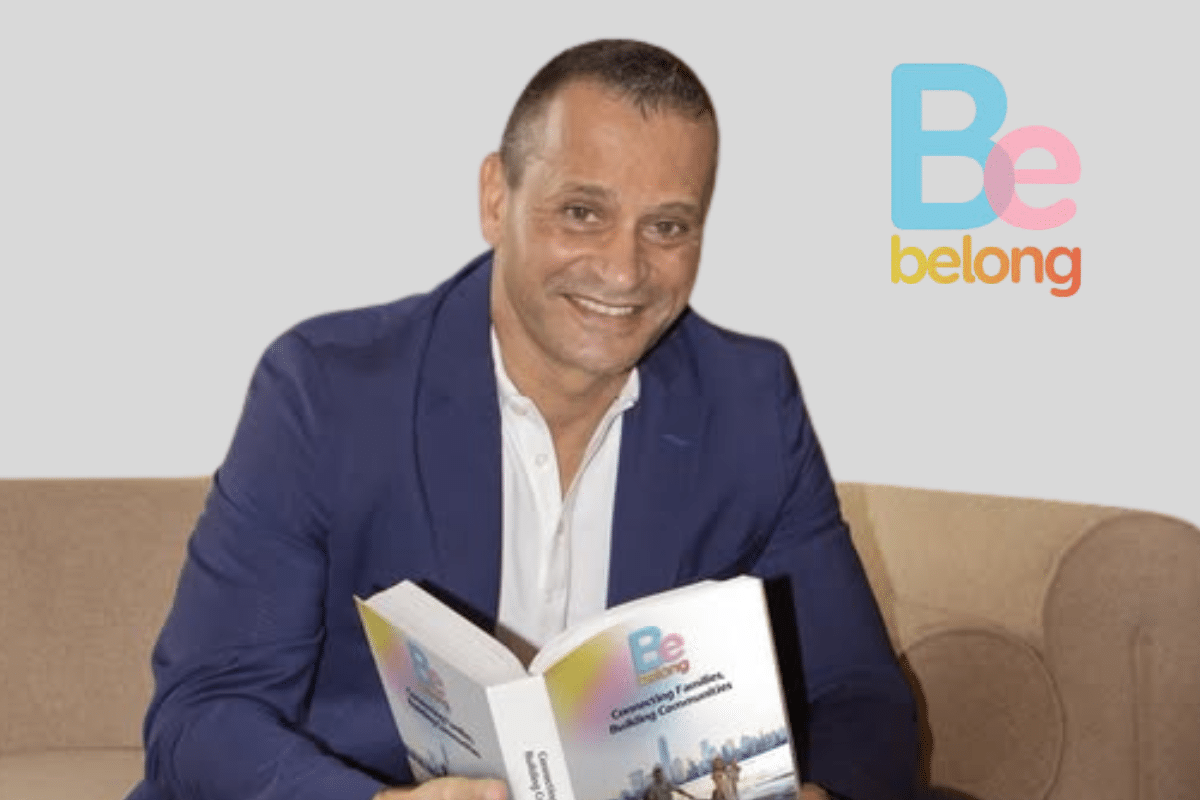

“This is a transformational moment for the RTL space,” said Alex Kaddah, Founder of Analytics Logics. “With the RTL Performance Dashboard, we are delivering the first standardized reporting tool built specifically for the needs of capital markets participants in private lending. Our mission is to help business leaders make informed decisions using accurate, real-time data.”

“As RTL moves into the institutional spotlight, performance data is essential,” said Aleksandra Simanovsky, Founder of Adige Advisory. “We built the RTL Performance Dashboard to enable lenders and investors to identify emerging market risks, benchmark performance, and demonstrate relative platform strength with hard market data and not just anecdotes.”

Industry-Driven Technology Built for Performance and Transparency

The RTL Performance Dashboard includes a comprehensive suite of features:

- Live Performance Analytics – Monitor delinquency, default, and loss metrics across credit characteristics.

- Customizable Drill-Down Views – Filter performance by region, property type, loan terms, and more.

- Performance Risk Indicators – Track key performance indicators to surface early warning signs and credit deterioration.

The dashboard recently powered insights for the article “Multifamily Is Winning the RTL Recovery”, published in the Summer 2025 issue of Private Lender. Data revealed that multifamily (5+ unit) loans have outperformed 1–4 unit residential loans since 2021, showcasing stronger credit discipline and stability in multifamily assets.